Tài liệu thuyết minh về Ngũ Hành Sơn

Khám Phá Ngũ Hành Sơn – Vùng Non Nước Huyền Bí

Ngũ Hành Sơn, một danh lam thắng cảnh nổi tiếng, tọa lạc cách thành phố Đà Nẵng khoảng 7 km về phía đông bắc. Đến với Ngũ Hành Sơn, du khách không chỉ được chiêm ngưỡng cảnh quan thiên nhiên tuyệt đẹp mà còn có cơ hội khám phá văn hóa, lịch sử độc đáo của vùng đất này.

Diện Mạo Kỳ Thú của Ngũ Hành Sơn

Ngũ Hành Sơn là tổ hợp của năm ngọn núi mang tên Kim Sơn, Mộc Sơn, Thuỷ Sơn, Hoả Sơn và Thổ Sơn. Mỗi ngọn núi đều có nét đặc trưng riêng, tạo nên sự phong phú trong trải nghiệm khám phá.

1. Kim Sơn – Ngọn Núi Khiêm Tốn

Kim Sơn là ngọn núi nhỏ nhất trong năm ngọn núi của Ngũ Hành Sơn nhưng lại mang sắc thái hùng vĩ. Ngọn núi này từng là nơi dừng chân để vua chúa ngắm cảnh lý tưởng.

2. Thủy Sơn – Ngọc Quý Của Ngũ Hành Sơn

Thủy Sơn là ngọn núi đẹp nhất, nơi du khách thường ghé thăm bởi cảnh quan hữu tình với nhiều chùa chiền cổ kính như Chùa Linh Ứng và động Thạch Nhũ. Để lên đến đỉnh núi, du khách sẽ phải trải qua khoảng 108 bậc thang, vừa tĩnh tâm vừa khám phá vẻ đẹp của rừng cây và phong cảnh.

3. Mộc Sơn – Hơi Thở Từ Thiên Nhiên

Mộc Sơn không có nhiều cây cối như tên gọi, nhưng vẫn mang lại cho du khách cảm nhận về sự yên bình và tĩnh lặng với những hang động nhỏ xinh.

4. Hoả Sơn – Chốn Tâm Linh Im Lặng

Hoả Sơn với những hang động cổ kính là nơi khai thác đá cẩm thạch, cũng như bảo tồn những di tích lịch sử của người Chiêm Thành ngày xưa.

5. Thổ Sơn – Ngọn Núi Nằm Ở Giữa

Thổ Sơn là ngọn núi thấp nhất, không có phong cảnh nổi bật nhưng là nơi lưu giữ nhiều truyền thuyết ý nghĩa của người Chiêm Thành, là biểu tượng của sự gắn kết giữa con người và đất đai.

Các Điểm Đến Du Lịch Nổi Bật Tại Ngũ Hành Sơn

Chùa Tam Thai

Chùa Tam Thai, được xây dựng từ năm 1630, là một trong những ngôi chùa cổ kính hấp dẫn du khách. Chùa nổi bật với thiết kế độc đáo và nhiều di vật lịch sử.

Chùa Linh Ứng

Chùa Linh Ứng, với tượng Quan Thế Âm Bồ Tát khổng lồ, là nơi được nhiều tín đồ Phật giáo đến cầu nguyện.

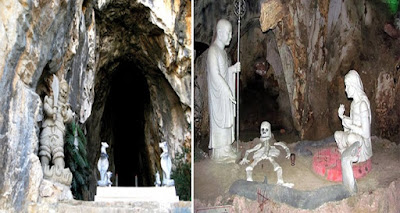

Động Huyền Không

Động Huyền Không mang trong mình vẻ đẹp huyền bí của ánh sáng và đá tự nhiên. Du khách sẽ được chiêm ngưỡng những tác phẩm điêu khắc độc đáo và tận hưởng không khí trong lành.

Tận Hưởng Dị Tầng Văn Hóa và Thiên Nhiên

Ngũ Hành Sơn không chỉ là một địa điểm tham quan; nơi đây còn là nguồn cảm hứng cho rất nhiều tác phẩm văn học và nghệ thuật. Các nhà thơ, nhạc sĩ đã lấy Ngũ Hành Sơn làm chủ đề cho các tác phẩm của mình, gợi nhớ và tôn vinh vẻ đẹp kỳ diệu của thiên nhiên nơi đây.

Kết Luận

Du lịch Ngũ Hành Sơn không chỉ mang lại cho du khách những trải nghiệm tuyệt vời về cảnh quan thiên nhiên mà còn là hành trình khám phá văn hóa, lịch sử và những giá trị tâm linh. Không chỉ là một địa điểm du lịch, Ngũ Hành Sơn còn là một phần không thể thiếu trong tâm hồn của người dân Đà Nẵng và của những ai đã một lần đặt chân đến nơi này.

Hãy khám phá ngay Ngũ Hành Sơn – nơi hội tụ của thiên nhiên và văn hóa!

Chúc bạn có chuyến đi vui vẻ và thú vị đến Ngũ Hành Sơn!

Nguồn Bài Viết Tư liệu thuyết minh NGŨ HÀNH SƠN